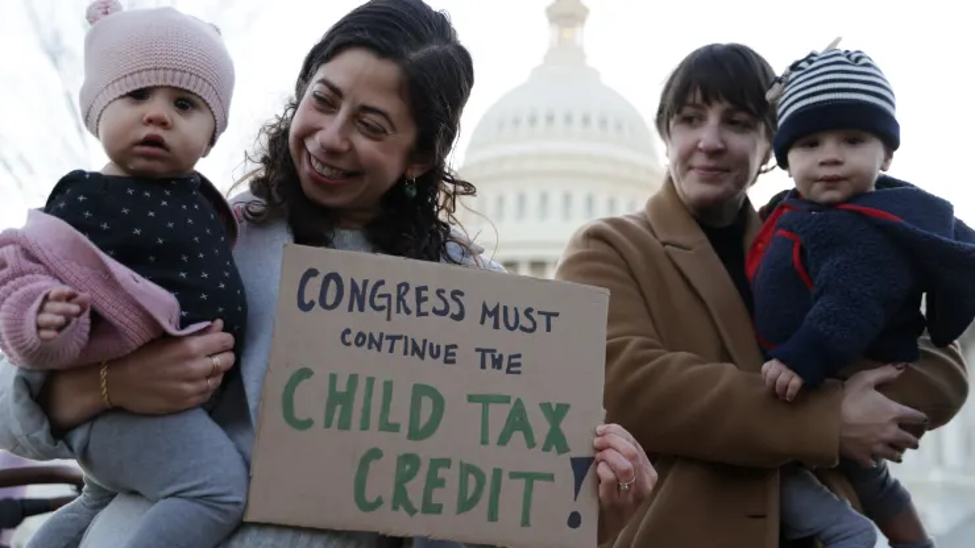

On March 11th, 2021 President Joe Biden signed the American Rescue Plan (ARP) which included a major temporary expansion to the Child Tax Credit (CTC), a means-tested deduction on federal income tax intended to support lower income families with eligible children. The expansion of the CTC was found to have reduced child poverty and hunger by 30% and if maintained, estimated to reduce child poverty by up to 50%. Despite this monumental achievement, Democrats in Congress failed to renew the extension successfully and as a consequence, millions of children fell back into poverty when the CTC expired in December of 2021. Over the following month, the child poverty rate jumped from 4.9% to 12.1% to 17%.

The reason? Democratic Senator Joe Manchin of West Virginia.

It was reported that Manchin felt the changes to the CTC were too liberal in spending and risked causing disincentives to work to its recipients. However, a study on Canada’s expansion of their child benefit, which was nearly twice as large as the expansion Biden issued, found no evidence of employment impacts. A cost-benefit analysis of the CTC found that while the expanded tax credit would cost 97 billion a year, it could generate social and economic benefits of $982 billion per year. He also privately expressed concerns that parents would waste the money on drugs. A survey in Manchin’s own state of West Virginia indicates that the CTC payments are overwhelmingly used for basic necessities, “91 percent of low-income households in West Virginia are using their monthly Child Tax Credit payments for basic household expenses such as food, clothing, shelter, utilities, and education”. To remedy these concerns Manchin wanted to institute a strict work requirement and limit the CTC to families making less than $60,000 a year. A resolution was not reached and the extension expired, reverting the credit back to its original state.

While the concerns regarding the CTC posed by Manchin do not seem to be valid they reflect the history of poorly designed welfare programs creating dependency. But Manchin’s proposed solutions of imposing more bureaucracy and means-testing would be counterproductive. The CTC fundamentally by design prevents the poorest from benefiting.

There is a minimum earned income requirement of $2500 to receive the CTC which acts as a soft work requirement. This not only flat-out excludes the poor but other groups who record little to no earned income such as grandparents on Social Security raising their grandchildren, an entrepreneurial single father forgoing a salary until their startup takes off. All of these families incur childcare costs and should be eligible to receive the CTC. There is no easy way to target this group of “unemployed welfare leeches” without catching people in the crossfire. Manchin and many policymakers seem to believe that it’s far more important to prevent people who “don’t deserve” welfare from receiving it rather than making sure those who need it do. Evidence of how damaging this mentality is for the CTC can be seen in the results of the expansion.

While Biden increased the size of the benefit dramatically the primary reason for the large reduction in poverty was not the increase of the benefit, but rather the alteration of the CTC to make it fully refundable. This removed the minimum income requirement and reversed the “phase-in” of the CTC. Previously if you owed less in income taxes than the full deduction you could only receive a portion of the benefit, if you made less than $24,000 you received less from the CTC than someone making more. This can be seen visually in this graph from the Tax Policy Center.

Lastly, the CTC already has the work requirement of raising and taking care of a child. The unpaid labor of childcare is a driving force of gender inequality and the money from the CTC is only a fraction of the compensation it’s worth.

The extended CTC showed us the true potential of the policy if we simply stopped excluding the poorest in an attempt to stop an imagined onset of unemployment or irresponsible spending.