Courtesy of TradiMo.

“I don’t think [economic] expansions just die of old age,” said Janet Yellen, which was followed by Ben Bernanke saying, “I like to say they get murdered.” This is a well-known exchange that happened between Janet Yellen, former Chair of the U.S Federal Reserve, and Ben Bernanke, another former Chair of the U.S Federal Reserve. Besides getting immortalised in Economics 101 classes all across the country, the expression nicely captures what awaits all economic expansions: recessions.

As we enter into the longest economic expansion in U.S history, the question of when the next recession will hit has become a bit of a political hot potato. People are wondering if another recession is overdue. Unfortunately, the question of “when?” is often answered with a strong and certain “soon” by industry experts and statistical analysts, yet no one is converging on a date.

However, instead of dwelling on when the next recession is coming, one could preemptively act to set the stage for damage control and recovery. Especially now that recession is within reasonable certainty. We may have more reasons to do so, as unfortunately, there are signs that suggest that the next recession is going to catch the U.S. economy off guard. Several of these signs are:

(1) Low-interest rates not reaching predicted growth in the economy

(2) The highest level of income inequality in recorded history in the U.S.

(3) Greater susceptibility to weakness in the global supply chain, evidenced by novel Coronavirus outbreak

All three problems hint towards an especially vulnerable economy if a recession is headed our way. But fortunately, there are some ways that we can account and prepare for them.

So how do recessions get handled? For reference, let us look at the 2008 financial crisis: there was a Hail Mary package from the Federal Reserve (700 billion dollars initially and 16.8 trillion dollars now), and interest rates were pulled down from their 4-5 percent range to their record low of 0.25 percent in December of 2008 to keep various investments from defaulting. This won’t be the case in 2020. The current 1.75 percent interest rate is not boosting the economy as much, indicated by an earning recession in the U.S. stock market as the S&P 500 earnings decline for a fourth straight quarter. Having interest rates this low means that if a recession were to hit, monetary rates might have to dip into the negatives. There won’t be any fight left in the monetary policy.

Courtesy of MacroTrends (blue graph shows Fed interest rate, grey areas highlight recessions).

In order to fix this, one possible solution is that we need a different banking regulatory system that would streamline fiscal policies, which are set by politicians, and monetary policies, which are set by bureaucrats. Perhaps a more radical possibility to help combat recession that some economists, such as Milton Friedman, suggest is the ‘Helicopter Money’ model. “What is ‘Helicopter Money’?” one may ask. This is exactly what it sounds like — money dropped down from helicopters. Though it may not be a good idea, it is an idea that Ben Bernanke, former chairman of the Federal Reserve, advocated for back in 2002. Desperate times, desperate measures.

Recessions hit those on the bottom rungs of the income ladder hardest. The GINI Coefficient of the U.S., standardised measurement of inequality across countries, with ‘0’ meaning perfect equality and ‘1’ meaning perfect inequality. In the United States, this coefficient is at a 30-year high. However, record high inequality has always been the case in every recession, so what’s different this time?

The issue is that the welfare program has more or less stayed the same whilst the pool of affected individuals has grown. Today’s working-class makes less inflation-adjusted income than their parents and grandparents did at their age. There is also an issue of rising inequality hampering on recession recovery. One could rightly ask what new emergent problem social calamity awaits in the fallout of a recession.

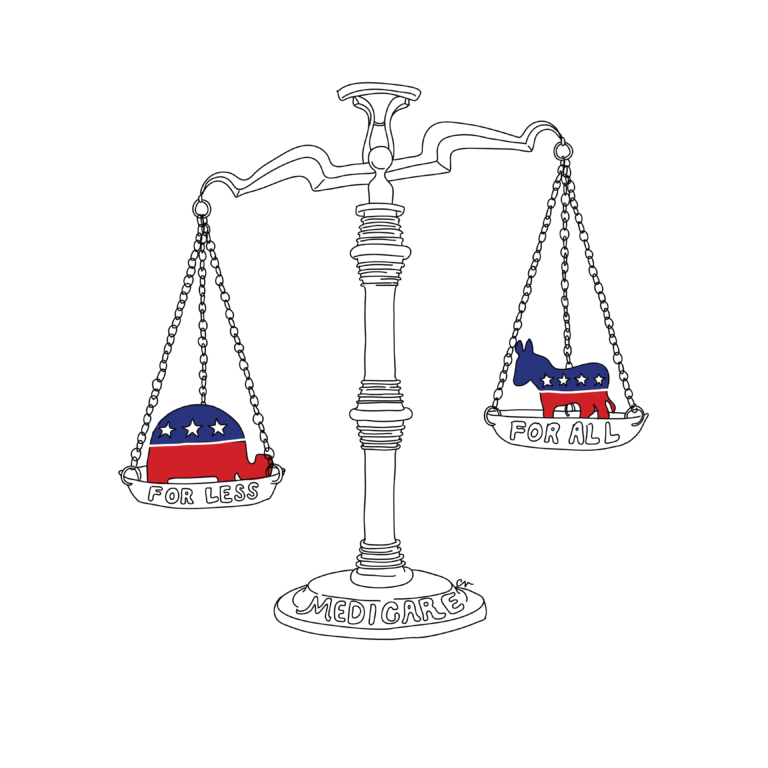

A possible solution for recession alleviation is an expansion in SNAP (Supplemental Nutrition Assistance Programme), TANF (Temporary Assistance to Needy Families), UI (Unemployment Insurance) and Medicaid, which are fiscal policies that have been proven to work to prevent low- and middle-class families from the brunt of a long recession, whilst boosting demand for business. A rare and happy instance of when ethics and economics directly overlap.

During happier times, the U.S. shared a symbiotic relationship with its trade partners. In 2008, strong demand and economic performance in Asia was able to shoulder some of the fallout from the U.S. financial crisis. The European Union also shouldered the burden. However, this could imply the inverse too — the U.S. may be susceptible to downturns in other countries.

Today, due to deep and non-retractable business ties, the U.S economic cycle is dancing closer and closer to China’s cycle. The recent novel coronavirus outbreak highlights just how crucial this dance is, as U.S. output fell to its lowest in six years due to slowing supply chains in China. Now with starting signs of an economic slowdown in the U.S, ‘The U.S. needs the rest of the world a bit more than last year,’ said Brad W. Setser, a senior fellow at the Council on Foreign Relations (a nonprofit think tank).

The logical and the most direct way to lessen this risk is to seek out more trading partners, as opposed to the opposite. More trading partners mean that risk will be shared, but recoveries will be faster and stronger. Since business can’t function without trading, it goes by definition that if we stopped trading altogether, we won’t have an economy to protect in the first place. After all, pulling out one’s teeth does reduce one’s risk of tooth decay.